Richland One is on track to receive a massive $22 million funding increase from Richland County on Tuesday, June 4, 2024, when County Council meets to approve its annual budget. The requested increase is the latest in an annual increase for the school district, year after year, of between $6 and $42 million. Meanwhile, the district has lost approximately 10 percent of its student population and already boasts the 3rd highest per student revenue in the State.

However, with County Council’s budget having already received two readings and unanimous votes approving the measure, taxpayers are on track for another hefty increase without clear answers as to why it is needed.

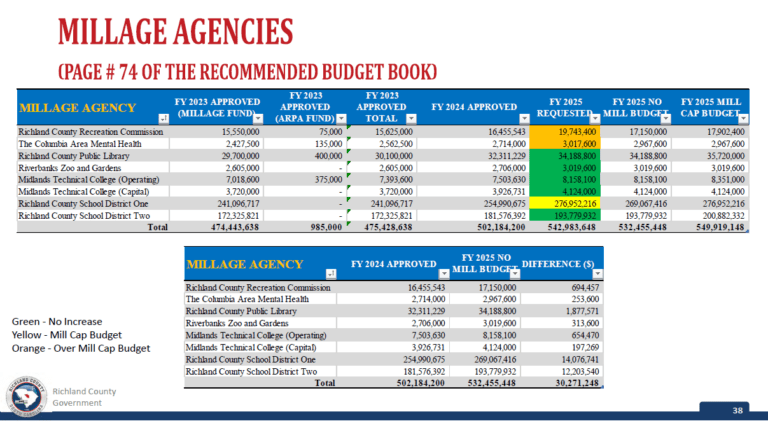

Millage Agencies

Here’s how this works. County councils pass an annual budget in the form of an ordinance that raises revenue and appropriates funds to fund various county services. One portion of this annual budget concerns something called “millage agencies,” which include things like school districts, the recreation commission, Midlands Technical College, and the library system. (A full list is available here.) Richland One is a millage agency.

Millage agencies are funded (at least in part) by property taxes, which are calculated by multiplying a millage rate by the assessed value of the property multiplied by the appropriate assessment rate. Each school district has its own millage rate, which is added to the county base rate (and any city millage) on an annual property tax bill. Millage agency funding increases are reflected in these annual property taxes. More funding = more taxes.

Richland One’s 2025 Request

This year, Richland One is seeking the maximum increase—i.e., the “cap”—from County Council. Notably, Richland Two is not requesting the cap, spends $6,000 less per pupil, and consistently outperforms Richland One based on objective student achievement. Richland One is also struggling to fill more than 500 certified and classified employee positions, meaning there are 500 paychecks in the current budget not being paid.

All of this begs the question, why is this massive increase needed and how is the requested additional $22 million planned to be used?

Accountability Opportunity

This tax increase is not a foregone conclusion. County council can still modify a mill cap request or reject it outright.

For example, last year, in a 7-4 vote, Richland One’s funding request was cut by county council by $6.6 million. The Post and Courier quoted County Council chair Overture Walker expressing concerns that the school district tax increase would overburden county residents; “Our job is to take into account the needs of not only the millage agencies (like school districts) but also the needs of our residents,” the paper reported. Exactly.

Notably, the paper also reported that Richland Two did not seek a tax increase, leading Councilman Don Weaver to conclude, “Richland Two is either doing a better job of balancing their budget or they’re able to be more frugal somewhere along the line.”

Richland County Council meets Tuesday, June 4 to give its budget a final reading. Councilmembers should give Richland One’s request greater scrutiny before handing it a blank check.

Contact your council member and share your concerns about Richland One’s request for this massive tax increase.